“Peak Oil” is a topic that returns to public view whenever the price of oil increases above its most recent price range. The concept of peak oil is often credited to M King Hubbert, a geologist who worked for Shell Oil in Houston for half of his career, and then worked for the USGS for the second half of his career. He saw oil supply forecasts as a planning tool to be used by Shell’s management. At the USGS he saw the forecasts as a useful strategic planning tool to be used by US policy makers. His USGS forecast was rejected by resource assessment geologists within the Survey. He predicted a peak of oil production from conventional oil fields in the Lower 48 states and near shore waters to occur in 1970. This did occur, and subsequently his forecasts for both US and global production gained a wide audience, including both supporters and skeptics.

The lower 48 forecast was made after many decades of production using a database compiled from a major producing company. Hubbert had access to a reasonably complete knowledge of region’s geology, production techniques, and production history.

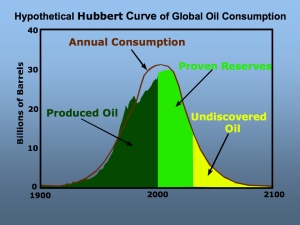

A similar knowledge base does not exist does to support a global forecast, as Hubbert knew very well. The figure shown above is modified from Hubbert’s prediction of global oil production from conventional oil fields made in 1969. The dark green area shows global production from 1900 to 2000 as compiled by Ron Charpentier of the USGS resource assessment group in Denver. The light green area shows proven reserves as reported by oil companies and national governments in 2000. These data are compiled by British Petroleum and published every year. The yellow area shows an estimate of undiscovered reserves estimated by the USGS as of 2000. The estimate is the mean of a forecast that ranges from very likely to be discovered ie more than a 95% of being discovered, to very unlikely of being discovered ie less than a 5% chance of being discovered.

There is little discussion regarding the quantity of oil produced to date in the figure. The volume is so large that unreported production would not change the graph. There is some real doubt as to the quantity that is proven but not produced. The doubt arises from the nature of the OPEC production quota setting process. Some observers do not believe all of the reports issued by OPEC members. Finally, the volume of oil to be discovered in the future is unknown. The technology and estimating processes simply do not provide a narrow estimate of future discoveries.

The “peak oil problem” thus seems to be a debate over the quantity of proven reserves and undiscovered oil. If you know these estimates, you simply plug in the total oil endowment of the planet into an equation, and a forecast results. If you disagree with other forecasters’ estimates of these volumes, then your forecast will differ from their forecasts.

But is this all there is to the peak oil problem? What about the curve that rises from zero, reaches a peak of some duration, and then falls to zero? This is an example of a logistics curve, which can be represents a differential equation. Hubbert expressed some doubts about this mathematical model for oil production. Note the historic production trend shown by the dark green area. Production rises and falls from 1900 to 2000. Some production changes reflect increasing supplies. Some changes reflect disruptions caused by economic recessions and wars. At every point in time on the historic production curve (the dark green area), the quantity produced and consumed reflects the effect of price on supply and demand. This raises an important question: can we predict the price of oil in the distant future? Can we predict the price of oil five, ten, 50 years from now? Can we relate such predictions to resulting future supply and demand?

The “Peak Oil Problem” is a problem with four variables, two or perhaps three of which cannot be known. We can agree on the volume of oil produced to date. There is some disagreement about the volume of discovered oil that has not been produced yet. We really don’k know how much oil will be discovered in the future. And no one has been able to predict the price of oil into the future. Many failed oil companies and commodity traders attest to this last fact.